Hello everyone,

I hope your Sunday is going well! I’ll quickly share my weekend routine and the stocks I’m keeping an eye on this week.

Let’s dive in! 👇👇

⸻

Quote of the Day

“The best traders have no ego. You have to swallow your pride and get out of the losses.” —Jack Schwager

⸻

NAAIM Exposure Index

The NAAIM Exposure Index decreased last week, ending at 81.41%, down from 94.09% the week before. Exposure remains at bullish levels, though not at extremes.

⸻

General Market Action

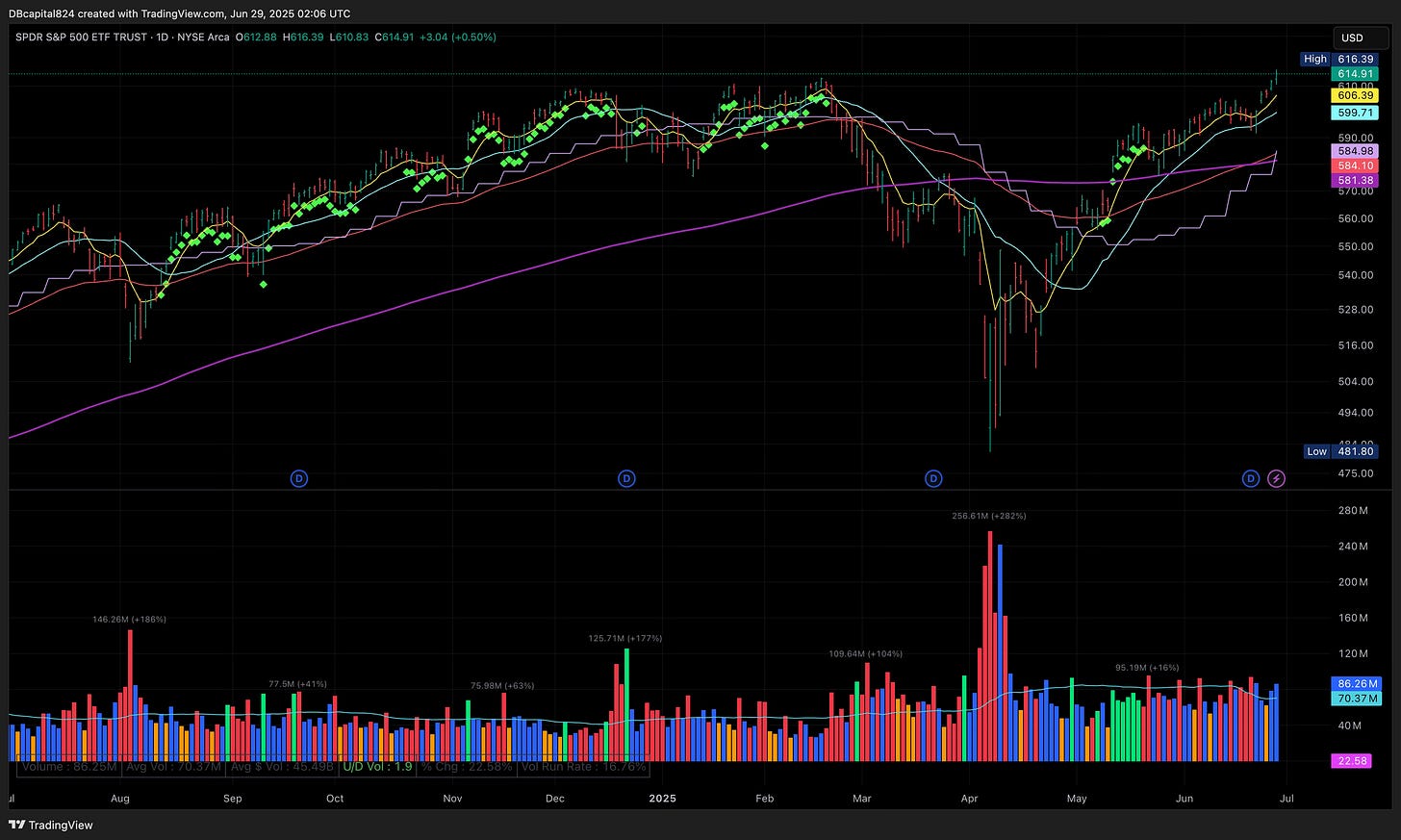

Bullish end to the week for the markets, with major indices finishing at all-time highs. QQQ and SPYsurged on Thursday and Friday, breaking out on high volume.

The market has been signaling that the correction is over. Many individual stocks that led the bounce from the April lows have already doubled in price.

Secondary indicators—such as net highs vs. net lows, put-to-call ratio, exposure levels, and sentiment data—have been leaning bullish for five consecutive weeks and continue to support a bullish outlook.

Even though my portfolio has performed very well, I haven’t made many moves over the last month. Very few stocks have met my buying criteria. I’ve mostly been sitting on my hands since May and letting my positions work.

I did take a hit from HIMS, which gapped down on Monday, triggering my stop loss and closing the position down 13%. PLTR also had a rough bar on Friday, decisively breaking below the 21-day moving average on volume. Let’s see if will finds support early next week.

For next week, the plan remains the same:

→ Watch and manage existing positions carefully

→ Avoid adding new long exposure for now

→ Stay disciplined, avoid FOMO, and don’t make careless mistakes

→ Wait patiently for new setups to emerge in market leaders

⸻

Market Leaders

• CRWD – Trending higher

• PLTR – Negative bar on high volume. Watching for stabilization

• DAVE – Trending higher after the recent shakeout

• SPOT – Trending higher after a 3-week tight breakout

• CRVW – Consolidating and building a high-tight flag setup

• ASTS – Moving sideways after doubling in a few weeks. Watching for a flag to form

• RBLX – Monster move. Holding above the 10 right DMA

• HOOD – Trending higher after breaking out of a cup-with-handle pattern

• COIN – Profit-taking after a strong week. Closed above the IPO pivot. Watching for sideways action above $340

⸻

Portfolio Update:

Long: PLTR, COIN, NVTS

Cash: 20%

⸻

Final Comments

The market continues to flash strong bullish signals across multiple indicators, and we’re seeing leadership from several tech and growth names. That said, discipline remains key—especially when many names have already made explosive moves. I’m staying selective and focused on high-probability setups while protecting capital. Sometimes the best move is simply to wait.

Let’s stay patient, stay sharp, and let the market come to us.

⸻

Here’s how you can support my work:

• Like this post

• Subscribe for free and share using the button below

Thanks again!

— Daniel, DB Capital824